An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future. On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company.

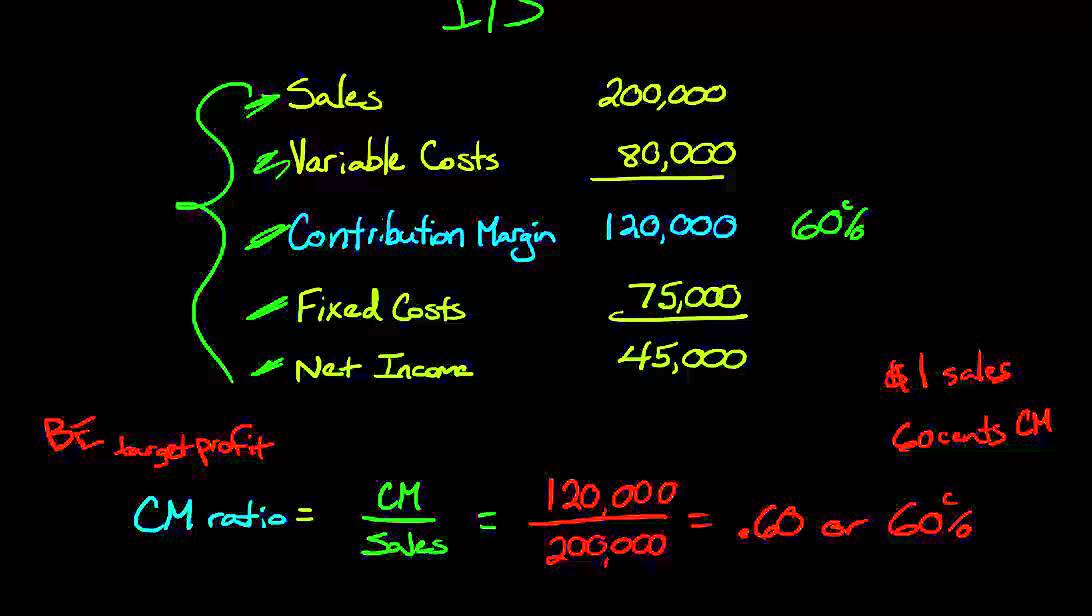

Contribution Margin Ratio:

A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business. To run a company successfully, you need to know everything about your business, including its financials. One of the most critical financial metrics to grasp is the contribution margin, which can help you determine marketing services for payroll companies how much money you’ll make by selling specific products or services. Variable expenses directly depend upon the quantity of products produced by your company. For example, if the cost of raw materials for your business suddenly becomes pricey, then your input price will vary, and this modified input price will count as a variable cost.

Variable Costs

- As you can see, contribution margin is an important metric to calculate and keep in mind when determining whether to make or provide a specific product or service.

- When comparing the two statements, take note of what changed and what remained the same from April to May.

- For example, it can help a company determine whether savings in variable costs, such as reducing labor costs by using a new machine, justify the increase in fixed costs.

- This strategy can streamline operations and have a positive impact on a firm’s overall contribution margin.

- Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently.

Whether you sell millions of your products or 10s of your products, these expenses remain the same. Thus, the contribution margin ratio expresses the relationship between the change in your sales volume and profit. So, it is an important financial ratio to examine the effectiveness of your business operations. Assuming factors like demand and competition are equal, the company should make the product with the highest return relative to variable costs in order to maximize profits.

Is contribution margin the same as profit?

Consider its name — the contribution margin is how much the sale of a particular product or service contributes to your company’s overall profitability. It’s how valuable the sale of a specific product or product line is. Increase revenue by selling more units, raising product prices, shrinking product size while keeping the same cost, or focusing on selling products with high margins. Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. Fixed and variable costs are expenses your company accrues from operating the business.

What is the Contribution Margin Ratio?

After all fixed costs have been covered, this provides an operating profit. This concept helps companies make decisions about whether to add or subtract a product line, to price a product or service, to determine the optimal mix of products, and to calculate the breakeven point. For instance, you can make a pricier version of a general product if you project that it’ll better use your limited resources given your fixed and variable costs.

However, you need to fill in the forecasted units of goods to be sold in a specific future period. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold. In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000.

All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units you sell, and then subtract the total variable costs from the total selling revenue. Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently. The contribution margin can be calculated by subtracting variable costs from sales revenue or by dividing the contribution margin per unit by the selling price per unit. This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit. Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit.

When calculating the contribution margin, you only count the variable costs it takes to make a product. Gross profit margin includes all the costs you incur to make a sale, including both the variable costs and the fixed costs, like the cost of machinery or equipment. The Indirect Costs are the costs that cannot be directly linked to the production. Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs. Furthermore, per unit variable costs remain constant for a given level of production.